GreenCycle Manufacturing is a medium-sized business that produces eco-friendly bicycles in Sheffield, UK. After a challenging Pandemic (2021) period, GreenCycle was looking forward to the UK Government’s recent Budget announcement (Autumn 2024), anticipating that the policies would lower taxes, lower inflation and boost consumer demand.

As a business committed to sustainable practices, GreenCycle sees some potential benefit from the creation of Government initiative, called National Wealth Fund, which promises to catalyze green investments. However, with inflation projected to stay high (fig. 1), the cost of raw materials may continue to rise, pressuring GreenCycle to adjust pricing or risk reduced profitability. Additionally, the projected increase in interest rates to bring down inflation would affect their expansion plans, as borrowing costs would rise.

(fig. 1)

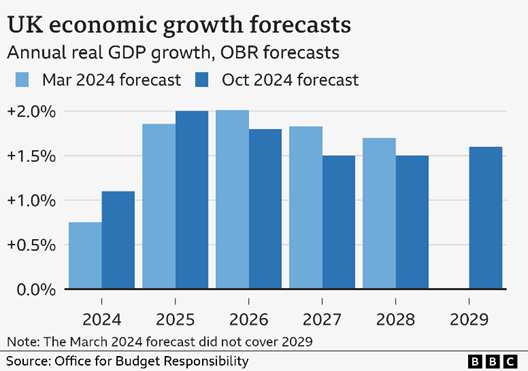

The Budget forecasts short-term growth peaking at 2% (fig. 2), which may briefly benefit GreenCycle by improving consumer spending and sales. However, the UK Government predicts that the impact of these measures will slow after two years, reducing growth to around 1.5%.

(fig 2.)

With the government’s plans to implement substantial tax increases by the end of the 2024/25 year, GreenCycle faces tough decisions. Although they could benefit from long-term stability if the economic reforms take hold, their immediate concern remains maintaining competitiveness amid these changes in the business environment.

GreenCyle is considering two strategies:

- Relocating its business and production abroad to Europe, where the economic situation is similar to the UK.

- Setting up a joint venture with another European company who don’t produce ‘green’ products but want to diversify.

Questions

- (2 Marks) Define inflation.

- (4 Marks) Explain two impacts of how the recent UK Budget’s announcement could affect GreenCycle Manufacturing.

- (10 Marks) Evaluate the two options facing GreenCycle.

—

Source: UK economy: Budget boost forecast to fade after two years, says OBR – BBC News, 30th October 2024.

The company name is fictious and used solely for the purpose of this exam question.

Case study, questions and company name created by L7 Tutors ltd.